Estás filtrando por

Se encontraron 3388 resultados en recursos

Compartir este contenido

Informe de Coyuntura Económica Regional - Sucre 2004 I Semestre

Copia el enlace o compártelo en redes sociales

Informe de Coyuntura Económica Regional - Quindío 2003 I Semestre

Compartir este contenido

Informe de Coyuntura Económica Regional - Quindío 2003 I Semestre

Copia el enlace o compártelo en redes sociales

Informe de Coyuntura Económica Regional - Tolima 2000 III Trimestre

Compartir este contenido

Informe de Coyuntura Económica Regional - Tolima 2000 III Trimestre

Copia el enlace o compártelo en redes sociales

Informe de Coyuntura Económica Regional - Tolima 2000 I Trimestre

Compartir este contenido

Informe de Coyuntura Económica Regional - Tolima 2000 I Trimestre

Copia el enlace o compártelo en redes sociales

Informe de Coyuntura Económica Regional - Cauca 2003 II Semestre

Compartir este contenido

Informe de Coyuntura Económica Regional - Cauca 2003 II Semestre

Copia el enlace o compártelo en redes sociales

Informe de Coyuntura Económica Regional - Chocó 2004 I Semestre

Compartir este contenido

Informe de Coyuntura Económica Regional - Chocó 2004 I Semestre

Copia el enlace o compártelo en redes sociales

Expansión - 01/12/20

Compartir este contenido

Expansión - 01/12/20

Copia el enlace o compártelo en redes sociales

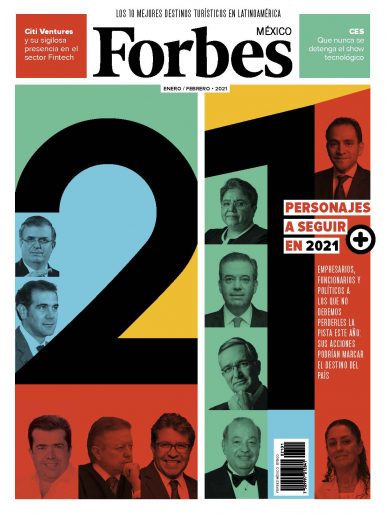

Forbes México - 20/01/21

Compartir este contenido

Forbes México - 20/01/21

Copia el enlace o compártelo en redes sociales

Forbes México - 16/12/20

Compartir este contenido

Forbes México - 16/12/20

Copia el enlace o compártelo en redes sociales

Business Concept - 15/12/20

Compartir este contenido

Business Concept - 15/12/20

Copia el enlace o compártelo en redes sociales

Selecciona las Colecciones en las que vas a añadir el contenido

Para consultar los contenidos añadidos busca la opción Tus colecciones en el menú principal o en Mi perfil.