Placeres literarios y gustos diversos

Esta colección de obras y autores del PPP Esperanza, es una selección atemporal y heterogénea que puede interesar a todo público por ser obras inmortales.

Madame Bovary

El Horla

El Llano en llamas, Pedro Páramo y otras obra

La inquisición y la cábala

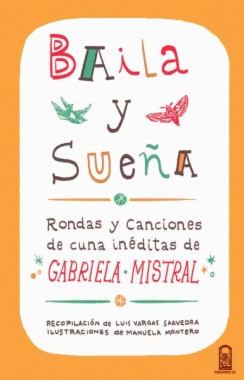

Baila y Sueña

Una profunda necesidad en la ficción contemporánea: la recepción de Borges en la república mundial de las letras

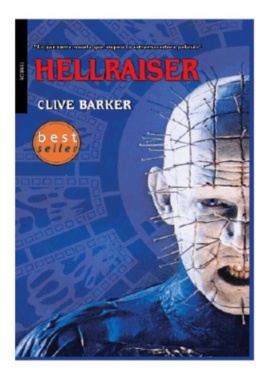

Hellraiser

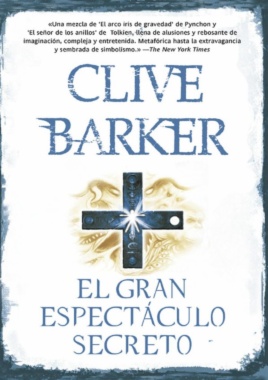

El gran espectáculo secreto

La montaña mágica

Cumbres Borrascosas

Para consultar los contenidos añadidos busca la opción Tus colecciones en el menú principal o en Mi perfil.